BIS:全球宏观金融韧性构建,货币政策与宏观审慎政策协同

导读

近年来,全球经济在疫情冲击、地缘冲突、利率高位回落缓慢等多重因素交织之下,增长动能趋弱、金融波动加剧。IMF《世界经济展望》2025报告中反复强调,在这样一个“不确定性偏高、冲击来得更频繁”的环境中,仅靠传统货币政策,很难同时兼顾稳增长、稳物价和稳金融三重目标,各国更需要通过宏观审慎政策提前为金融体系“加垫子”、为货币政策“减负”。具体而言,在报告第二章《新兴市场的韧性:好运还是好政策?》IMF从“好运”和“好政策”两个维度,系统分解了为什么近年来不少新兴经济体在多轮“risk-off”冲击中表现出前所未有的韧性。IMF 对新兴经济体经验的系统研究表明,那些在危机前就通过资本监管、杠杆约束、外汇相关宏观审慎工具等手段降低金融脆弱性的经济体,在全球金融条件收紧、风险偏好逆转时往往产出收缩更小、资本外流更可控。通胀目标制、汇率弹性与宏观审慎框架的共同完善,是支撑部分经济体在多轮外部冲击中保持相对稳定的关键“好政策”组合,而不是“单纯的好运”。

在这一全球政策共识的背景下,宏观审慎政策的定位也在悄然发生变化:从过去危机后“被动清理战场”,转向在平时就“主动构建跨周期韧性”,通过可释放的资本缓冲,为未来可能到来的下一轮冲击预先储备空间。基于这一背景,IMI货币研究所选取 Bank for International Settlements (BIS) 的文章《Macroprudential and monetary policy interaction: the role of early activation of the countercyclical capital buffer》编译,在深入探索报告选题的同时,从欧元区实践出发,系统分析宏观审慎政策与货币政策之间的互动关系,尤其是反周期资本缓冲(CCyB)早期激活如何提升银行体系的吸损能力,减少金融稳定目标与价格稳定目标之间的潜在冲突。在梳理 IMF《世界经济展望》关于全球宏观金融环境和政策取向的相关判断基础上,重点解读欧洲央行这篇文章的核心结论,探讨以反周期资本缓冲早期激活为代表的宏观审慎工具,如何与货币政策形成更紧密的协同,共同提升经济体应对冲击的韧性,以飨读者。

以反周期资本缓冲早期激活为核心的政策协同——全球宏观金融韧性构建新路径

在全球宏观金融环境不确定性攀升、非预期冲击频发的背景下,货币政策与宏观审慎政策的互动关系成为维护经济金融双稳定的关键议题。《Macroprudential and monetary policy interaction: the role of early activation of the countercyclical capital buffer》一文,围绕宏观审慎政策的转向逻辑、反周期资本缓冲(CCyB)早期激活的实践价值及两大政策的协同机制展开深度分析,为理解全球宏观政策创新提供了重要参考。

文章开篇即指出,全球宏观金融环境的深刻变革推动宏观审慎政策重心从“被动应对金融周期风险”转向“主动构建跨周期韧性”。新冠疫情、俄乌冲突等非金融冲击的爆发,打破了“风险仅源于金融体系内生失衡”的传统认知——这类冲击与信贷过度扩张、房价泡沫等无关,却能引发剧烈经济波动,凸显了“通过可释放资本缓冲保障金融体系抗冲击能力”的重要性。这一转向不仅重塑了宏观审慎政策的目标体系,更让其与货币政策的互补性进入新维度:通过提前积累韧性,宏观审慎政策可有效抵消货币政策调整对金融稳定的潜在副作用,为货币政策聚焦核心目标“减负”。

反周期资本缓冲(CCyB)的早期激活,是文章论证的核心实践工具。不同于传统“风险升高后再调整”的模式,早期激活机制强调在金融周期初期、系统性风险尚未凸显时,逐步构建“正中性CCyB率”,其价值体现在三方面:一是提前储备损失吸收能力,应对数据滞后导致的风险误判或非预期外生冲击;二是通过“跨周期平滑积累”,降低资本缓冲提升对银行经营、信贷供给的短期成本;三是为政策协同提供纽带——当金融体系具备充足韧性时,货币政策无需在“抑制通胀”与“防范金融风险”间权衡,即便在货币紧缩周期,银行也可通过释放缓冲吸收损失,避免信贷收缩加剧经济压力。文章通过动态随机一般均衡(DSGE)模型与压力测试验证:CCyB早期激活可使金融压力场景下GDP收缩幅度减少0.2个百分点,银行违约概率上升幅度降低3.5个百分点,且不削弱货币政策控通胀效果。

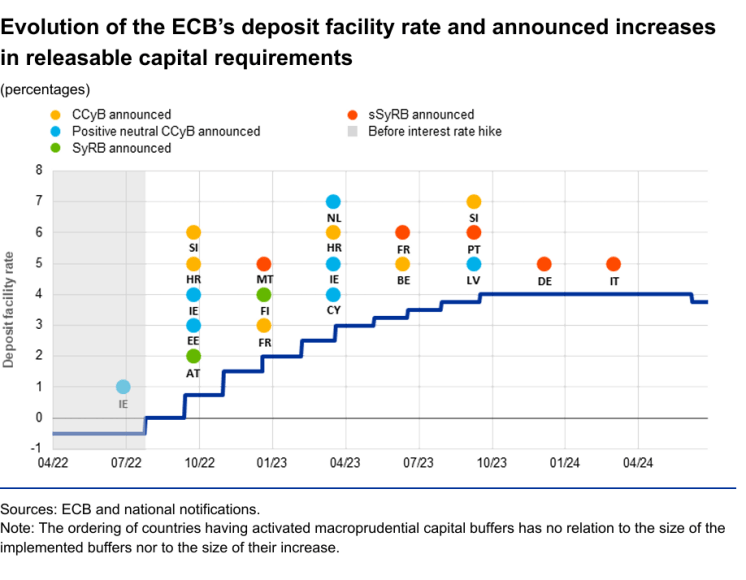

在政策协同维度,文章突破了“货币政策专注价格稳定、宏观审慎政策专属金融稳定”的传统“分离原则”,明确宏观审慎政策应成为抵御金融风险的“第一道防线”。一方面,货币政策调整存在显著金融稳定溢出效应——长期宽松易催生信贷泡沫,短期紧缩可能触发利率与信用风险,而宏观审慎政策通过CCyB、系统性风险缓冲(SyRB)等工具,可针对性化解这些风险;另一方面,在欧元区等货币联盟中,宏观审慎政策的灵活性可适配各国金融异质性,弥补单一货币政策的不足,减少区域金融失衡。2022-2023年欧元区货币紧缩周期的实践印证了这一逻辑:尽管欧洲央行存款便利利率从-0.5%升至4.5%,但多国仍逆势激活CCyB与SyRB,银行高盈利能力与充足资本缓冲消化了政策成本,最终推动欧元区宏观审慎空间从2019年的0.35%提升至2024年的1%,所有银行联盟国家均建立可释放缓冲。

文章结论明确,宏观审慎政策向“前瞻性韧性构建”的转向,是对全球宏观金融环境变化的必然回应;CCyB早期激活则是这一转向的核心载体,也是实现政策协同的关键。未来政策需进一步强化两大方向:一是持续以可释放缓冲工具构建跨周期韧性,确保金融体系应对各类冲击的能力;二是巩固宏观审慎政策“第一道防线”角色,让货币政策更专注于价格稳定目标,最终实现“金融稳定”与“价格稳定”的长期兼容。这一研究不仅为当前全球宏观政策调整提供了实践指引,更为应对未来不确定性、防范系统性风险奠定了理论与实证基础。

原文节选

In its strategy review published in 2021 the ECB already emphasised the complementary of macroprudential and monetary policy. ts 2025 monetary_policy strategy assessment also clearly acknowledges that financial stability is a precondition for price stability,and vice versa.It thereby confirm the complementary of objectives and underscores the importance of taking financial stability considerations into account in monetary policy deliberations. Complementary with respect to enhancing mutual policy effectiveness is most evident when financial and business cycles are synchronized and both policies align in either a tightening or loosening direction,thereby reinforcing each other. During periods of financial cycle expansion and above-target inflation,higher macroprudential cyclical capital buffers would complement a tighter monetary policy stance by increasing lending rates and reducing risk taking inentives, while tighter borrower based measures would promote more prudent lending. However,d-synchronised business and financing cycles,as well as national supply shocks, challenge the traditional notion of complementarity betwen macroprudential policy and monetary policy, which may need to act in different directions and may, therefore,not be complementary from a cyclical perspective. This could happen, for example,when financial contraction occurs alongside high inflation, warranting a monetary policy tightening and a macro prudential loosening. However, the later argument is only relevant to the traditional focus of countercyclical macroprudential policy, which is aimed at smoothing credit cyclical.

In a monetary union with a homogenous monetary policy, the flexibility of macroprudential policies can account for heterogeneities at the country, sector and institutional level to safeguard resilience against systemic risks. Heterogeneities driven by different regulatory and institutional settings and the differing structural features of financial sectors, fragmented markets, desynchronised cycles and exogenous shocks may all contribute to asymmetries in the build-up of systemic vulnerabilities across countries and exposure to systemic shocks. Targeted and more granular macroprudential policies allow these risks to be addressed in a more tailored manner, complementing the euro area-wide monetary policy by limiting potential unintended side effects in specific jurisdictions and/or sub-segments of the macro-financial system.

来源

来源:

Bank for International Settlements (BIS)

时间:

2025年08月

作者:

Carsten Detken, Hannah S. Hempell and Mara Pirovano

原文二维码:

选题:海外宏观经济选题组

编译:霍传志

监制:崔洁、李婧怡

版面编辑|周佳敏

责任编辑|李锦璇、阎奕舟

主编|朱霜霜

下一篇:没有了